Please share broadly:

In the November 2020 election, San Diego County voters will have the opportunity to vote on Proposition 15, the “Schools & Communities First” initiative, which was put on the ballot by a record 1.7 million Californians to raise critical revenue for our children, families, and future by closing a corporate tax loophole while protecting small businesses, homeowners and renters.

Here’s what voters should know about Prop 15:

1. Prop 15 Ends Corporate Tax Loopholes.

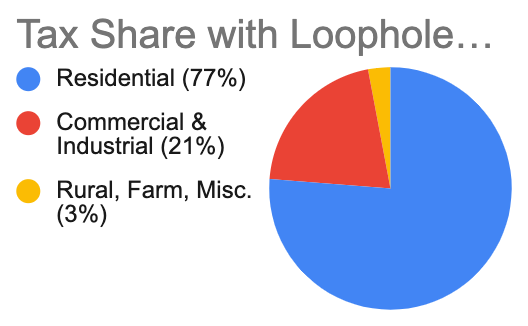

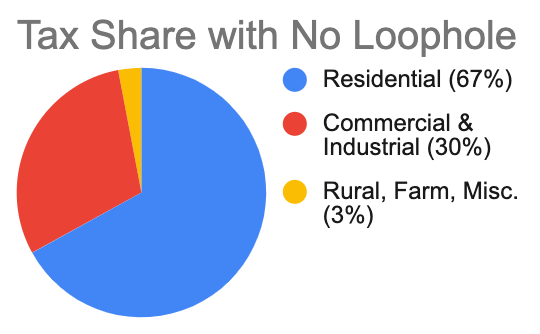

Prop 15 closes a loophole created in a 1978 ballot measure that enabled large corporations with commercial and industrial properties to avoid paying their fair share of taxes, passing on that cost to residents. Property taxes are what pay for local schools, community colleges, and essential government services. According to the County of San Diego in this report in Table 23, residential property owners currently pay 77% of all property taxes, while commercial and industrial property owners pay only 21%.

If Prop 15 were to pass, the University of Southern California Program for Environmental and Regional Equity (PERE) estimates it would increase the assessed valuation of commercial and industrial property in the county by $70 billion resulting in an estimated additional $700 million in taxes paid by corporations. This would increase the tax share of commercial and industrial properties to 30% and reduce the residential share to 67%.

The 1978 loophole was created when voters passed Prop 13. Voters were motivated by the protection for homeowners — not corporations — that the measure provided, allowing residential property owners to pay taxes on the sale price of their property rather than the market value. The idea was that this would allow residents to age in their homes and when the property was sold, its value would be reassessed and new owners would pay new taxes. Since then, most homes in San Diego County have been sold and reassessed. According to this report in Figure 38, more than 80% of homes in the county have changed hands since 1990, more than 50% since 2000, and nearly 25% since 2010. Every time a residential property changes hands, the property is reassessed and the new owner pays new taxes.

The same should be true for commercial and industrial properties, but they turn over more slowly and even when they do, corporations use accounting tricks to avoid paying their fair share. Since 1978, a handful of large corporations have used Prop 13 to avoid paying any new taxes. Iconic examples are Disneyland and SeaWorld, both of which are traded on the stock market and owned by shareholders making billions of dollars. Though shareholders change, that will never trigger a reassessment. As a result, these iconic tourist attractions may never pay more in property taxes. They charge 2020 ticket prices and pay 1978 property taxes, while the schools and communities that surround them suffer from chronic underfunding.

Other examples in our region are the multiple exclusive country clubs around the county — many of which have historically excluded Jewish community members and minorities and still limit access to this day. The clubs have vast amounts of land, charge exorbitant fees, and benefit from extremely low property taxes, which act as a subsidy for their businesses. One such club is the San Diego Country Club, which is located in Chula Vista and pays pennies per square foot in property taxes while new homeowners in the area pay nearly 50 times as much and the city struggles to create green space and provide basic essential services to residents.

2. Prop 15 Funds Schools and Communities.

Prop 15 will generate an estimated $12 billion a year for all Californians. It is the only revenue measure on the ballot and is much needed to help us recover and prepare for the future. The revenue is specifically allocated to local schools (40%) and local services (60%). None of the money will stay in Sacramento. Prop 15 explicitly states that its purpose is to “distribute the new revenue resulting from this measure to schools and local communities, not to the State.”

Benefits of Prop 15 Revenue in San Diego County

The University of Southern California PERE estimates that this will generate an additional $700 million for San Diego County. Every school (including charter schools), every community college, every city, and every fire, water, and healthcare district in the county will gain much needed revenue. Find out how much your school and community would gain.

Here is a breakdown of how Prop 15 revenue would benefit schools and communities:

| K-12 Schools | Teachers, classroom aides, computers, books, science equipment, librarians, nurses, extracurriculars, and other supports to help students thrive.

|

|

| Community Colleges | Academic counseling, financial aid, tutoring, child care and support to help students succeed. Community colleges train more than three-quarters of our nurses, firefighters and EMTs. Nearly half of UC students who earn a degree in science, tech, engineering and math transferred from a community college.

|

|

| City & County Services | Emergency response, public health services, mental health services, community clinics, sanitation services, utilities, street and sidewalk repair, lifeguards, job training, housing assistance, youth programs, libraries, parks, and recreation centers. Social services to reduce homelessness, help seniors, feed children, care for foster youth, and provide domestic violence shelters.

|

|

| Special Districts Services | Respond to wildfires, keep drinking water safe and accessible, fund public hospitals, and build and maintain infrastructure including transportation. |

The money for schools in Prop 15 will flow to community colleges and K-12 schools. Every campus and every school will get additional revenue, and the schools with greater needs will get more as calculated by the existing Local Control Funding Formula (LCFF). How the money is used by each school will be determined by the local parent-teacher-student governance teams that already exist and currently allocate resources through LCFF. Prop 15 will not change how money flows through LCFF, but rather increase the flow to meet the needs of students.

Likewise, the money for local government services in Prop 15 will be distributed through the existing allocations in each county with money flowing based on property tax collections and population. The County of San Diego reports on the allocation of property tax revenue in detail for all to see. In addition to this existing local reporting, Prop 15 provides for full accountability, transparency and oversight of the revenue generated and allocated through the California Board of Equalization. Because of these provisions, a judge ruled that the opposition’s assertion that there is not accountability is false and misleading.

3. Prop 15 Protects and Boosts Small Businesses.

Prop 15 recognizes that small businesses are the backbone of our economy — nine out of ten businesses are small businesses in San Diego and in California. They employ the majority of the workforce and constitute the majority of the economy. Small businesses are also a proven pathway to build income, independence and economic security, especially for women, people of color, immigrants, young adults, veterans, disabled people, and rural residents.

That’s why Prop 15 explicitly exempts businesses from increased taxes on commercial and industrial properties valued at $3 million or less. This figure is indexed for inflation to continue to protect small businesses into the future. Only one out of ten commercial and industrial properties are valued over $3 million. Businesses whose total properties are valued at less are exempt. Prop 15 also exempts all home-based businesses, which make up half of all small businesses, as part of the protection of all residential properties. In addition, Prop 15 exempts all agricultural lands including farms.

Prop 15 also encourages new and existing businesses to make new investments by eliminating the business tangible personal property tax on equipment and fixtures for small businesses and providing a $500,000 per year exemption for all other businesses. This means restaurants can upgrade their kitchens, start-ups can purchase computers, and other small businesses can invest in the machinery, furniture, and tools to help them grow and succeed.

In addition to this specific help, Prop 15 supports small businesses by investing in healthy communities that business owners, their employees and their families depend on. When we require corporations to pay their fair share and use our collective tax dollars to invest in the common good, we all benefit. Small businesses also benefit from a more level playing field that Prop 15 creates by eliminating the corporate tax loophole. When all properties valued over $3 million are assessed based on their actual market value rather than their purchase price, businesses can compete more fairly knowing they are all paying their fair share to support the schools and communities from which they benefit.

So who will pay increased taxes? New analysis shows that just 10% of all commercial properties will account for 92% of all the new revenue.

The taxes are concentrated on those at the top who have avoided reassessment through financial schemes or who are legacy corporations that will never transfer enough ownership to trigger reassessments. They are not many; they are few, and if they paid their fair share, they would help fund our future.

We know the opposition campaign has fanned fears that big business will leave California if Prop 15 passes, but we’ve heard that kind of threat before and it hasn’t happened. The reality is that no other state provides the loophole to corporations that Prop 13 provides. Moreover, California property taxes are among the lowest in the nation according to Figures 3 and 4 in this report. Nevertheless, the opposition is threatening that corporations will pass their increased costs on to small-business renters or to consumers. But corporations don’t set rents — the market does — and tenants in triple-net leases will have time in the phase-in period in Prop 15 to renegotiate their leases. It’s a renter’s market right now.

Likewise, consumers can choose to shop elsewhere. For example, four gas stations anchor a street intersection in University City. They all charge the same, even though they pay very different property taxes based on the year they bought their property. The reason that one does not charge more is that consumers will choose its competitor. That’s how the market works.

4. Prop 15 Protects Homeowners and Renters.

Prop 15 protects all residential properties from increased taxes. This includes all homes, condos, apartments and other residential properties. The ballot measure is explicit about this and the first statement of purpose and intent in the measure is to:

“Preserve in every way Proposition 13’s protections for homeowners and for residential rental properties. This measure only affects the assessment of taxable commercial and industrial property…. All residential property is exempt so homeowners and renters will not be affected in any way by this measure.”

Despite the clarity in the text of the measure, opponents have repeatedly asserted that the measure will increase taxes on homeowners and home-based businesses. This is simply not true. Voters challenged the opponents in court when they tried to insert this argument into the ballot pamphlet. A judge ruled that the language was “false and misleading” and ordered it stricken. Despite the judge’s order, the opposition continues to attempt to deceive voters.

5. Prop 15 Promotes Equality.

Prop 15 is a historic, systemic, equitable, and long-term solution that will usher in a new era of investment into what matters most — our children, our families, and our future. The corporate loophole it would close has been devastating and has starved our schools and communities for decades. We cannot say we are committed to racial, economic and social justice, yet ignore the harm caused by chronic disinvestment that has disproportionately harmed communities of color.

The consequences of chronic disinvestment are profound. Using schools as one example, the per-pupil spending in California K-12 schools has fallen from 7th to 39th in the country since 1978, and we are now dead last in the ratio of students to teachers, counselors, and nurses. The impact of this disinvestment has fallen heaviest on students of color and low-income children. As another example, California Community College students, two-thirds of whom are people of color, often take more than 2 years to earn a two-year degree because the courses they need aren’t offered when they need them. Our cities and counties have also suffered from chronic budget shortfalls — and we’ve been forced to “nickel and dime” our way to provide services through sales taxes, parcel taxes, and fees on utilities, parking, and other services.

The COVID crisis has laid bare inequities in our society and has been a wake up call, revealing neglect and underinvestment in vital public health departments, public hospitals and community clinics. This has left them underprepared for the current crisis as well as future crises. This is also true for our firefighters, who have entered another wildfire season without the equipment and personnel they need. The consequences of chronic disinvestment are many.

Year after year, residents are asked to tax themselves to cover the funding gap created by large corporations taking advantage of these loopholes. While corporate property taxes stagnate, cities seek more and more funding through bond measures, often paid for by increasing property taxes on homeowners. Cities also seek to raise sales taxes, which land harder on low-income communities and communities of color.

With Prop 15, we can reverse this trend and reinvest in the public institutions that help everyone get ahead — especially communities of color and low-income communities. This is an important step to building an inclusive economy where everyone has opportunity and shares in prosperity, where everyone can live in dignity and support themselves and their families, and where everyone contributes their fair share to create healthy communities where all of us can thrive.

For more information visit yes15.org